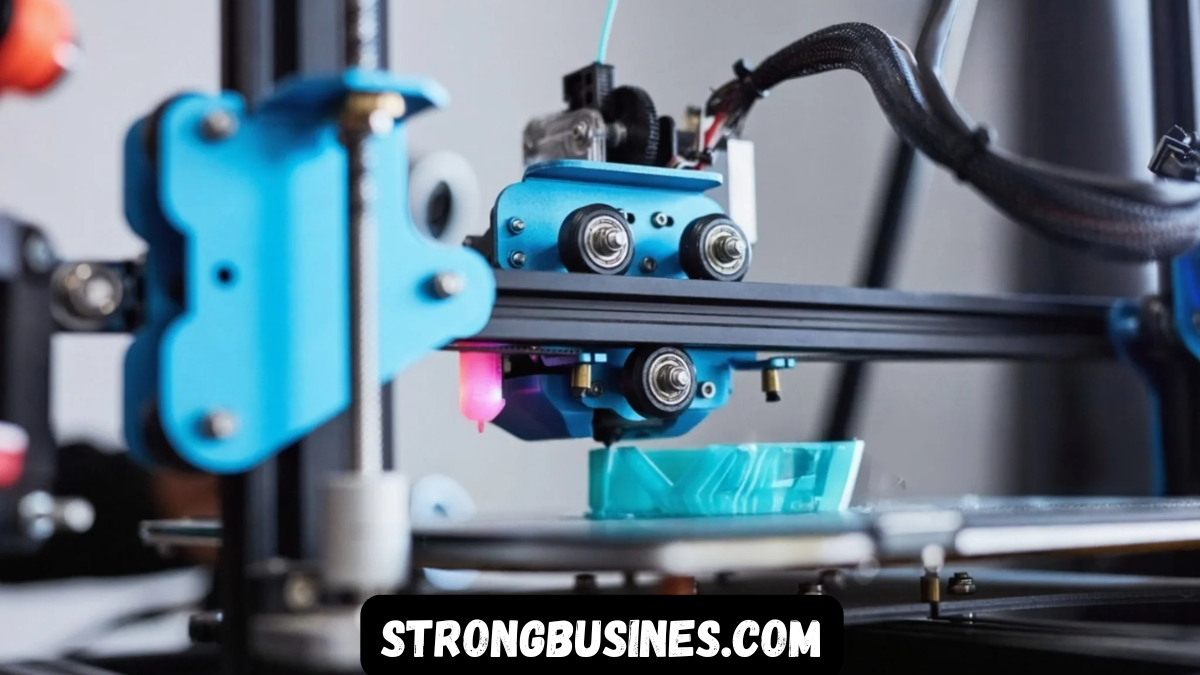

Understanding the Role of 3D Printing in Modern Industry

5StarsStocks.com 3D Printing Stocks known as additive manufacturing, has transitioned from a niche technology into a transformative force across various sectors. From aerospace and automotive to healthcare and consumer products, its influence continues to grow. Companies are embracing 3D printing for rapid prototyping, cost-effective manufacturing, and innovative design solutions. The technology is no longer confined to labs or small-scale production; it now plays a pivotal role in industrial-scale operations.

As this trend accelerates, investors are increasingly looking to capitalize on its potential. That’s where platforms like 5StarsStocks.com step in, offering crucial insights and investment guidance in sectors like 3D printing. The platform identifies high-potential stocks and helps users analyze market data with clarity. Focusing on 3D printing stocks, 5StarsStocks.com provides resources for understanding emerging companies and established leaders in the field.

Why 3D Printing Stocks Are Gaining Attention

The global demand for customization, rapid manufacturing cycles, and sustainability has driven the adoption of 3D printing. Traditional manufacturing often results in material wastage and longer lead times. In contrast, 3D printing uses only the material necessary and allows for on-demand production. This efficiency appeals to businesses looking to streamline operations and reduce overhead.

The pandemic further highlighted the versatility of 5StarsStocks.com 3D Printing Stocks During supply chain disruptions, many manufacturers turned to 3D printing to produce essential parts and medical equipment locally. This shift showcased the technology’s potential as a reliable solution in times of crisis.

Investors are attracted to the growth trajectory of the 3D printing market. With increasing use cases and technological advancements, the sector is expected to grow significantly in the next decade. Platforms like 5StarsStocks.com offer a consolidated view of these market shifts, helping both novice and seasoned investors identify stocks aligned with these trends.

5StarsStocks.com A Strategic Tool for Investors

Navigating the stock market, especially within specialized industries, requires more than just basic information. 5StarsStocks.com has emerged as a platform that blends data analytics, expert commentary, and real-time insights to guide investors. The site covers multiple sectors but has carved a niche in highlighting next-gen technologies like 3D printing.

Its analytical tools help users track performance indicators, assess financials, and compare industry benchmarks. For those specifically interested in 3D printing, the platform offers stock breakdowns, historical data, and forecasts. This comprehensive approach gives investors a clearer picture of which companies are best positioned to succeed in the additive manufacturing space.

Another feature of 5StarsStocks.com is its focus on long-term value. It doesn’t merely spotlight trending stocks; it evaluates their sustainability and adaptability. In an industry like 3D printing, where innovation is constant, this perspective is essential. The platform aims to highlight companies with robust R&D pipelines, strategic partnerships, and scalable business models.

Key Drivers Behind the Growth of 3D Printing Stocks

The proliferation of 3D printing technologies is fueled by several critical factors. One major driver is the decreasing cost of 3D printers and materials. As these technologies become more affordable, small and medium enterprises are able to adopt them, increasing overall market penetration.

Another driver is the integration of 3D printing in education and research institutions. Universities and technical colleges are incorporating 3D printing into their curriculum, fostering innovation at the grassroots level. This academic interest is feeding into the commercial sector, where new talent and fresh ideas continue to emerge.

Government support has also played a significant role. Policies encouraging domestic manufacturing, R&D tax incentives, and defense contracts are accelerating the growth of companies involved in 3D printing. The healthcare sector, in particular, has seen exponential growth, with 3D printing being used for prosthetics, surgical tools, and even bioprinting of human tissues.

Investors using 5StarsStocks.com can monitor how these drivers influence stock performance. By analyzing market catalysts in real-time, the platform enables proactive investment decisions based on factual developments rather than speculation.

Risks and Challenges in 3D Printing Investment

Despite its promising future, 3D printing stocks are not without risk. The industry is still evolving, and many companies operate at a loss as they invest in technology and infrastructure. Profit margins can be thin, and competition is fierce. Additionally, regulatory hurdles in sectors like healthcare can delay product approvals, affecting timelines and revenue projections.

Market volatility is another concern. Like many tech-related industries, 3D printing stocks can experience rapid fluctuations in value based on market sentiment, technological announcements, or macroeconomic trends. Investors must be cautious and informed, particularly when investing in smaller or newly public companies.

5StarsStocks.com addresses these concerns by providing real-time risk assessments, volatility metrics, and sector comparisons. This allows users to understand the potential downside and adjust their strategies accordingly. Long-term investors may find opportunities in undervalued stocks, while short-term traders can benefit from price movements tracked by the platform’s tools.

Spotlight on Innovation and Patents in 3D Printing

Innovation is the lifeblood of the 3D printing industry. Companies that consistently innovate—either through material science, software development, or hardware design—tend to gain a competitive edge. Patent portfolios are often a key indicator of a company’s potential. Firms with strong intellectual property protections are more likely to secure strategic partnerships and long-term contracts.

5StarsStocks.com tracks patent activity and R&D spending across the industry. Investors can review which companies are leading in innovation and how that translates into stock performance. This correlation between technological advancement and shareholder value is especially significant in a rapidly evolving space like additive manufacturing.

Software is also a growing area of innovation. Advanced modeling tools and design platforms that integrate with 3D printers are crucial to improving efficiency and precision. Companies offering end-to-end solutions—including hardware, software, and materials—often attract more institutional investment. The platform provides performance analytics and insights on these vertically integrated businesses.

Environmental and Ethical Impact of 3D Printing

Sustainability is becoming a priority in global investment strategies, and 3D printing plays a crucial role in eco-friendly manufacturing. Additive manufacturing often uses fewer raw materials and produces less waste compared to traditional methods. Moreover, localized production reduces the need for long supply chains, lowering the carbon footprint.

Companies incorporating biodegradable materials, recycled feedstocks, and energy-efficient technologies are gaining favor with ESG-conscious investors. 5StarsStocks.com includes environmental impact metrics in its stock evaluations, giving users a holistic view of a company’s footprint.

The platform also covers ethical issues surrounding intellectual property, labor practices, and supply chain transparency. With growing interest in responsible investing, this added layer of analysis helps investors align their portfolios with their values.

Global Trends Shaping the Future of 3D Printing Stocks

The global nature of 3D printing adoption means that developments in Asia, Europe, and North America all affect the stock landscape. For example, Europe’s investment in sustainable manufacturing and Asia’s focus on consumer electronics have created regional hotspots for innovation. Meanwhile, North America remains a hub for high-end industrial applications and defense-related advancements.

Trade policies, international partnerships, and supply chain logistics all play a role in shaping market trends. 5StarsStocks.com aggregates data from global sources, enabling users to understand international impacts on domestic stock performance. It also tracks how geopolitical events influence sector dynamics, allowing for a more informed and diversified investment approach.

The platform provides country-specific outlooks, showing where growth is expected and which markets are saturated. This allows users to identify geographic regions where 3D printing stocks might outperform due to local economic conditions or regulatory advantages.

Institutional Involvement and Market Maturity

As the 3D printing industry matures, institutional investors are starting to take note. Hedge funds, mutual funds, and pension funds are increasingly including 3D printing companies in their portfolios. This influx of capital stabilizes stock prices and brings greater visibility to the industry.

Mergers and acquisitions are another sign of a maturing market. Larger firms are acquiring smaller, innovative startups to gain access to proprietary technologies. These activities can boost stock prices and create momentum in the sector. 5StarsStocks.com tracks these M&A activities and provides insights on how such moves affect investor sentiment and stock value.

The platform also highlights companies that are close to profitability or have achieved it, helping users separate speculative stocks from those with proven business models. This segmentation is essential for constructing a balanced and risk-mitigated investment strategy.

The Long-Term Outlook of 3D Printing Stocks

The long-term potential for 3D printing remains strong. As more industries adopt the technology and it becomes embedded in manufacturing processes, demand for reliable and scalable 3D printing solutions will continue to grow. Medical advancements such as tissue engineering, aerospace parts production, and construction using 3D-printed materials represent frontiers that could redefine entire industries.

Investors looking to benefit from this evolution should maintain a diversified portfolio while staying informed on technological shifts and regulatory changes. 5StarsStocks.com serves as a continuous source of information, allowing users to track both macro and micro trends.

By focusing on long-term fundamentals, strategic partnerships, and innovation pipelines, the platform empowers users to make educated decisions. The future of 5StarsStocks.com 3D Printing Stocks is not just about machinery; it’s about transforming the way we build, design, and create. Those who recognize this early—supported by insightful tools like 5StarsStocks.com—will be well-positioned to reap the rewards.

Conclusion

The convergence of innovation, sustainability, and digital transformation has positioned 3D printing as a cornerstone of future manufacturing. With platforms like 5StarsStocks.com offering actionable insights and data-driven strategies, investors have more tools than ever to explore and benefit from this burgeoning industry. Whether you’re a cautious investor looking for long-term gains or a market-savvy trader eyeing rapid shifts, 3D printing stocks present a unique opportunity in the evolving world of technological investment.